Summary: While automatic for most, Medicare Part B is optional. Should you decide to forgo signing up as soon as you are eligible, you’ll face a Medicare Part B penalty without creditable coverage. The Part B penalty doesn’t ever go away, but some beneficiaries can delay enrollment without facing it. You can also appeal the decision. Estimated Read Time: 12 mins

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

Table of Contents:What Is the Penalty for Canceling Medicare Part B?Common Scenarios to Avoid Where the Medicare Part B Penalty May ApplyIs There a Cap on the Medicare Part B Penalty?How To Avoid the Medicare Part B PenaltyWhen Does the Medicare Part B Penalty Apply?When Does the Part B Penalty Not Apply?What if I Don’t Sign Up for Medicare Part B Because I Have Other Health Insurance?How Do I Appeal the Medicare Part B Penalty?What Is the Penalty for Not Taking Medicare Part B?Medicare Plan B PenaltyHow to Avoid the Medicare Part B Late Enrollment PenaltyIf you are newly eligible for Original Medicare and do not enroll in Medicare Part B, you may have to pay the Medicare Part B penalty. The Part B penalty results in a higher premium every month you have Part B benefits, and unfortunately, it never goes away.

For some beneficiaries, you can delay enrollment while also avoiding the Part B late enrollment penalty. However, you’ll need to qualify. Others may be tempted to avoid paying for coverage, but because the Medicare Part B late enrollment penalty lasts forever, it’s typically better to sign up as soon as possible.

But it’s essential to keep in mind that everyone’s healthcare needs are different. Below, we’re breaking down how to calculate Medicare Part B penalties, how to avoid them, and the considerations you’ll want to remember to make an informed decision for your coverage.

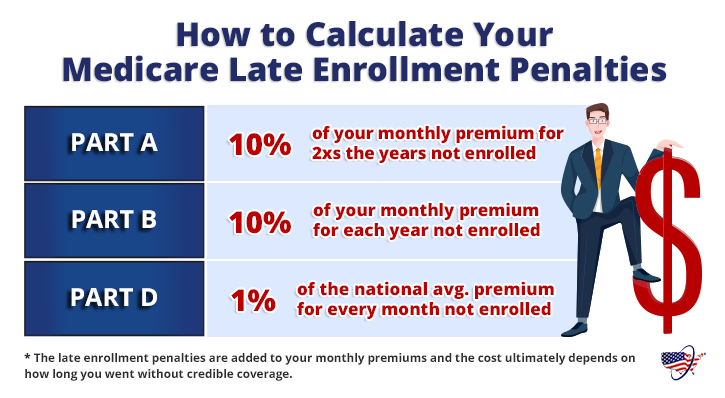

What Is the Penalty for Canceling Medicare Part B?The Medicare Part B penalty increases your monthly Part B premium by 10% for each full 12-month period you did not have creditable coverage. The Part B penalty is based on the standard Medicare Part B premium, regardless of the premium amount you actually pay.

Calculate Your Medicare Part B PenaltyUse the calculator below to determine how much your Medicare Part B penalty will cost.

Medicare Part B Penalty CalculatorIf you do not enroll in Medicare Part B when you first become eligible, and you don’t have other creditable coverage, you may face a late enrollment penalty. The penalty is added to your monthly premium.

For example, if you pay a higher Part B premium based on your previous tax returns, your penalty will only be 10% of the base Part B premium. The penalty will not be 10% of your Income-Related Monthly Adjustment Amount premium.

For most, the Part B Medicare penalty never goes away. You must pay the additional premium cost as long as you have coverage. The only time the late enrollment penalty for Part B goes away is if you are eligible for Part B prior to age 65 and pay the penalty before turning 65. Once you turn 65, the Medicare Part B penalty is reset, and you will no longer be responsible for the additional premium.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

Common Scenarios to Avoid Where the Medicare Part B Penalty May ApplyOnce you are eligible for Original Medicare, knowing how to avoid additional costs is essential. Medicare Part B penalties are an additional cost that no one plans for, and everyone hopes to avoid, especially when it comes to healthcare.

Education is key, and by preparing yourself, you can avoid the late penalty for Medicare Part B. Here are some examples of scenarios to avoid if you do not want to pay the Medicare Part B Penalty:

You retire at 65 and continue retiree coverage until 70, then decide to enroll in Medicare Part B. Doing so will delay Part B enrollment and face the penalty.You lose employer coverage and wait longer than eight months to enroll in Medicare Part B.You do not have insurance coverage and wait until you are 67 to enroll in Original Medicare.You delay Medicare Part B coverage enrollment because of VA benefits past age 65.These scenarios are just a few examples of how you can be stuck paying the Medicare Part B penalty for life. If you avoid these scenarios or similar ones, you can avoid paying the penalty altogether.

Is There a Cap on the Medicare Part B Penalty?As of now, there is no cap when calculating the Medicare Part B late enrollment penalty. However, legislation has been introduced to cap the Medicare Part B penalty at 15% of the current premium, regardless of how many 12-month periods the beneficiary goes without coverage.

H.R.1788 is an example of legislation introduced to reduce the Part B penalty, but so far, nothing has passed. Bills are either under review, expired, or simply failed to pass so far. However, a cap would save thousands of beneficiaries from the high cost of the penalty for Medicare Part B.

How To Avoid the Medicare Part B PenaltyThere are many ways to avoid the Medicare Part B penalty, most of which include the time in which you enroll in coverage. When it comes to Medicare, timing is everything. Thus, enrolling on time helps eliminate paying a late enrollment penalty. Here are a few tips to avoid the Medicare Part B late enrollment penalty.

Enroll During Your Initial Enrollment PeriodThe best time to enroll in Medicare coverage is during your Initial Enrollment Period. If you’re turning 65, you can enroll in Medicare Part B during this enrollment period.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

Your Initial Enrollment Period is the first chance you get to enroll in Medicare coverage. Thus, making you ineligible for a penalty is you enroll during this time.

Enroll During the General Enrollment PeriodIf you do not enroll in Medicare Part B during your Initial Enrollment Period, you’ll usually need to wait for the General Enrollment Period before you can enroll in coverage.

When you use this Medicare Part B enrollment window, your coverage will be active on the first day of the month following your enrollment. The General Enrollment Period is available to those who delayed Medicare Part B benefits without creditable coverage.

If you wait to enroll until the General Election Period to enroll in coverage, and you do not let an entire 12-month period go by without Medicare Part B coverage, you will avoid the penalty.

Enroll During a Special Enrollment Period Due to Creditable CoverageIf you delay Medicare Part B due to creditable coverage, you will be eligible for a Special Enrollment Period. This will allow you to bypass any penalty for Part B benefits.

Additionally, if you are approved for a Medicare Savings Program, this will erase the Medicare Part B penalty even if you would otherwise be responsible for the additional premium. Keep in mind that to qualify for a Medicare Savings Program, you must meet specific income criteria. Not every beneficiary will qualify for this program.

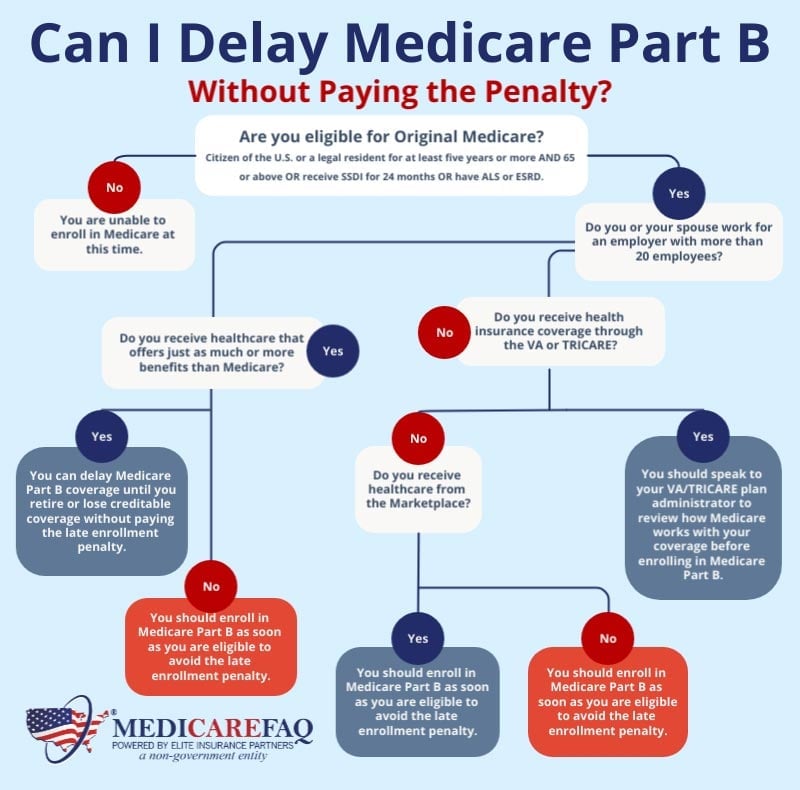

You may also be able to delay Medicare Part B enrollment without a penalty if you receive healthcare benefits from the military. However, the relationship between TRICARE, the U.S. Department of Veterans (VA), and Medicare is complex. Before making any decisions, you’ll need to contact your local VA to be sure.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

Just to recap how you may be able to avoid a penalty:

Enroll in Part B benefits as soon as you are eligible.You or your spouse receive benefits that are considered credible coverage.You qualify for a Special Enrollment Period.When Does the Medicare Part B Penalty Apply?The Medicare Part B penalty applies when you delay Part B benefits without creditable coverage.

The video below shows Bob, who chose to delay his Medicare Part B enrollment. Shortly after Bob retired at 65, his wife fell ill. Due to her medical costs, Bob decided to delay his Medicare Part B coverage in order to help pay their medical bills. Little did he know that the longer he waited to enroll, the more his Medicare Part B late enrollment penalty grew. Watch the video to see how things turn out for Bob.

When Does the Part B Penalty Not Apply?Those who miss their initial enrollment deadline but sign up during the next General Enrollment Period will not pay the Part B premium penalty if less than 12 months have passed. When you enroll during the General Enrollment Period, coverage goes into effect on on the first day of the month following enrollment.

So, imagine your Initial Enrollment Period ends on November 30. If you do not enroll until February, the General Enrollment Period, only three months will pass before your coverage becomes effective on March 1. Thus, the penalty will not apply.

Also, those under 65 with Medicare who are paying the penalty will not pay after 65. Further, those with Medicaid need not worry about Medicare Part B premiums and penalties because their state will cover those costs.

Finally, anyone who delayed Medicare Part B and did have creditable coverage can avoid the Part B penalty by qualifying for a Special Enrollment Period. Once you have a Special Enrollment Period, you have a set amount of time to enroll and avoid the Medicare Part B penalty.

Enrolling during this time means you are not liable for late penalties. You may also qualify for equitable relief if a federal employee told you that you did not need to sign up for Medicare Part B when you were supposed to enroll.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

What if I Don’t Sign Up for Medicare Part B Because I Have Other Health Insurance?There are situations where you can keep your current health insurance. You can keep your plan if you have creditable coverage through your employer, spouse’s employer, or a union. You will not have to pay the penalty for delaying Medicare Part B coverage.

However, if your coverage is not creditable or you lose coverage (voluntarily or involuntarily), the clock begins to tick.

Usually, you will be able to sign up for Medicare Part B right away during a Special Enrollment Period. This is an eight-month window beginning when your employer coverage ends. If you do not enroll during this period, you will have to pay the Medicare Part B penalty. You will pay a 10% premium increase for each full 12 months you wait beyond the date the Special Enrollment Period began.

If you retire before age 65 and choose to extend your coverage using COBRA, you must end COBRA coverage once you are eligible for Medicare. COBRA is not creditable coverage to avoid the penalty.

How Do I Appeal the Medicare Part B Penalty?If you feel that the Medicare Part B penalty should not apply, you may request a review. Medicare has reconsideration request forms to appeal your penalty.

Unfortunately, you will still pay the penalty while waiting for your appeal to process. Additionally, there is no timeline for processing your Medicare Part B late enrollment penalty appeal.

The Office of Medicare Hearings and Appeals (OMHA) collaborates with the Social Security Administration (SSA) to handle the processing of Medicare Part B late enrollment penalty appeals. Your first step is to contact SSA to reconsider, which can be done by calling 1-800-772-1213.

It should be noted that SSA has had reconsideration forms online available in the past, but as of this writing, the process seems to have moved in a different direction. To inquire about the forms and to appeal your Part B penalty, remember that calling SSA is the initial route you’ll want to take.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

What Is the Penalty for Not Taking Medicare Part B?Technically, you’ll only incur the Medicare Part B penalty if you delay enrollment. You don’t have to enroll in Part B should you choose not to. However, when you delay Part B enrollment, you need to remember the following:

The Part B penalty never goes away. Therefore, once you’ve made the decision to delay enrollment, you’ll have the penalty forever should you sign up in the future.Not only does that mean adding healthcare costs, but you’ll also need to face your outpatient costs through other means.Healthcare costs continue to rise, and these expenses also become more predominant, statically, for beneficiaries who qualify for Medicare.Finally, healthcare needs change over time. Even if you’re healthy now, you may face the penalty later on because you’ll enroll in the coverage you need.Planning ahead, staying educated, and working with a licensed insurance agent are great ways to avoid making the wrong decision. For most, enrolling in Medicare Part B as soon as possible is typically advised.

Medicare Plan B PenaltyA common mistake beneficiaries often make is mixing up Medicare Part B and Medicare Plan B. This can be important when speaking about the penalties, coverage, and costs. Here are a few important things you’ll need to know about the Medicare Plan B penalty:

Medicare Part B is the outpatient portion of Original Medicare. These benefits come from the federal government.You can incur the Medicare Part B sign-up penalty, as mentioned above when enrolling late if you don’t qualify for delaying enrollment. However, there is no “Medicare Plan B penalty” because Medicare Supplement plans don’t have penalties for late enrollment.You may, however, pay higher premiums or be denied coverage if you don’t enroll in a Medicare Supplement plan as soon as you are eligible.At the end of the day, there are several considerations when it comes to your healthcare. There are also several individual factors because everyone has different healthcare and budget needs. Working with a licensed insurance agent can help you explore your options and make an informed decision while keeping costs low.

Was this article helpful ?Yes (89)No